News Americas, NEW YORK, NY, Weds. Sept. 7, 2022: A Caribbean and African American-owned US-based asset management firm has now opened an arm in Jamaica.

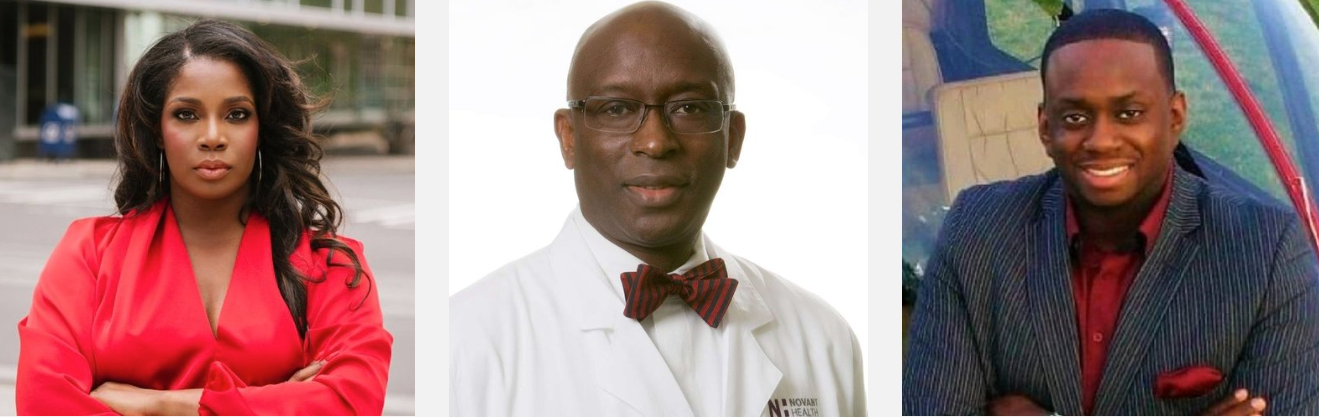

Black Pearl Global Investments, (BPGI), founded by Jamaican Dr. Carl Smart; North Carolina-born Dr. Shante Williams and Venezuelan Marlon Joris, invests in companies innovating in the health determinants space, primarily focused on those located in North America, Africa, and the Caribbean.

The firm also globally deploys funding in the form of venture capital, private equity, and private lending. Its mission is to equitably accelerate the deployment of funding to the companies, entrepreneurs and innovators who need it most and to where it can make the most impact. “Jamaica was a natural fit for our Caribbean Headquarters,” Dr. Smart said. “Establishing our first Caribbean office here was deeply personal and it will act as an anchor for all of our activities throughout the region.”

Dr. Williams, BPGI Global President and CEO, explained: “We are here to support the health sector with a mix of solutions for both debt and equity capital partnership. BPGI’s expertise is in supporting entrepreneurs grow their businesses – not only with capital deployment, but with access to network and knowledge necessary to advance an organization.”

Global Black Pearl Limited (GBPL) is the entity registered in Jamaica by the General Partners of BPGI, which leads the deployment of capital within the Caribbean.

So far they have exited one health position, closed the 5th venture with Goldman Sachs as lead broker and has recently entered into an agreement to acquire Florida-based contact lens manufacturer, Hydrogel Vision Corp. (HVC).As a result of the acquisition, HVC will be known as Black Pearl Vision, becoming the only Black-owned and woman-led contact lens manufacturer in the world. The deal is expected to close by mid-September.

“Our ticket sizes are in the range of USD 10,000 – 750,000 and we are excited to support the Caribbean market,” Williams affirmed.

BPGI will invest in and acquire early and growth stage companies transforming healthcare using innovation. “The investment strategy focuses primarily on Caribbean companies with a global potential. We are seeking to accelerate the Caribbean as an innovator in the healthcare sector, so we want to partner with visionary founders that are redefining how healthcare is provided and consumed whilst delivering better outcomes for all,” said Daniel Smart, Director of the Caribbean.

The Black Pearl Global Investments team brings investment, medical, technology, and health expertise to the table: “In 2020, digital health start-ups in the USA attracted a record US$14 billion of investment capital, in the largest funding year on record. Jamaica is rich with brilliant innovators and yet funding is only starting to see traction,” Williams expressed. “BPGI mission is to change that by helping to magnify Jamaica’s best and brightest. We have developed a robust pipeline of opportunities and hope to be considered the preferred capital partner for health entrepreneurs.”