News Americas, NEW YORK, NY, Weds. May 11, 2022: The battle for racial equality has been fought for many years, but data shows that there is still a big economic disparity among different racial and ethnic groups in America. The Survey of Consumer Finances reveals that white families have the highest level of both the typical and average amount of family wealth among all races in the US. Unfortunately, the average Hispanic family only reaches around 17% of the wealth of white American families, while black families reach less than 15%.

Recognizing the financial gaps across various races, institutions have established financial resources to help individuals learn how to manage their money. The rise of financial literacy programs for immigrants in America is more important than ever, and here’s how you can access them.

Addressing the Financial Literacy Gap for Immigrants

While white Americans are already established in the country, many immigrants try to pursue the American dream in hopes of having a better financial future. In fact, poverty is one of the top factors that push Guatemalans to brave through the difficult journey of migrating to the US. The country is ripe for financial opportunities, considering that rural Guatemala only has a few banks and financial institutions that can assist citizens in their professional and personal goals.

This story is very similar to the backgrounds of the majority of immigrants. Most individuals start from scratch once they arrive in the US, which is why many institutions are producing resources to address the financial literacy gap among immigrants.

Resources that Promote Financial Literacy

State-based resources

Upon welcoming immigrants into their state, governmental bodies provide financial education and resources to help you reach your financial goals within the country.

To illustrate, California offers various services under the New American Financial Education Resource program to assist immigrants with various financial concerns. Through their departments, you can take advantage of legal services, community education programs, and even financial assistance to help you get established in the US. Similarly, Florida and Massachusetts established a Financial Literacy for Newcomers program so that you can learn crucial concepts based on the American financial system.

Digital resources

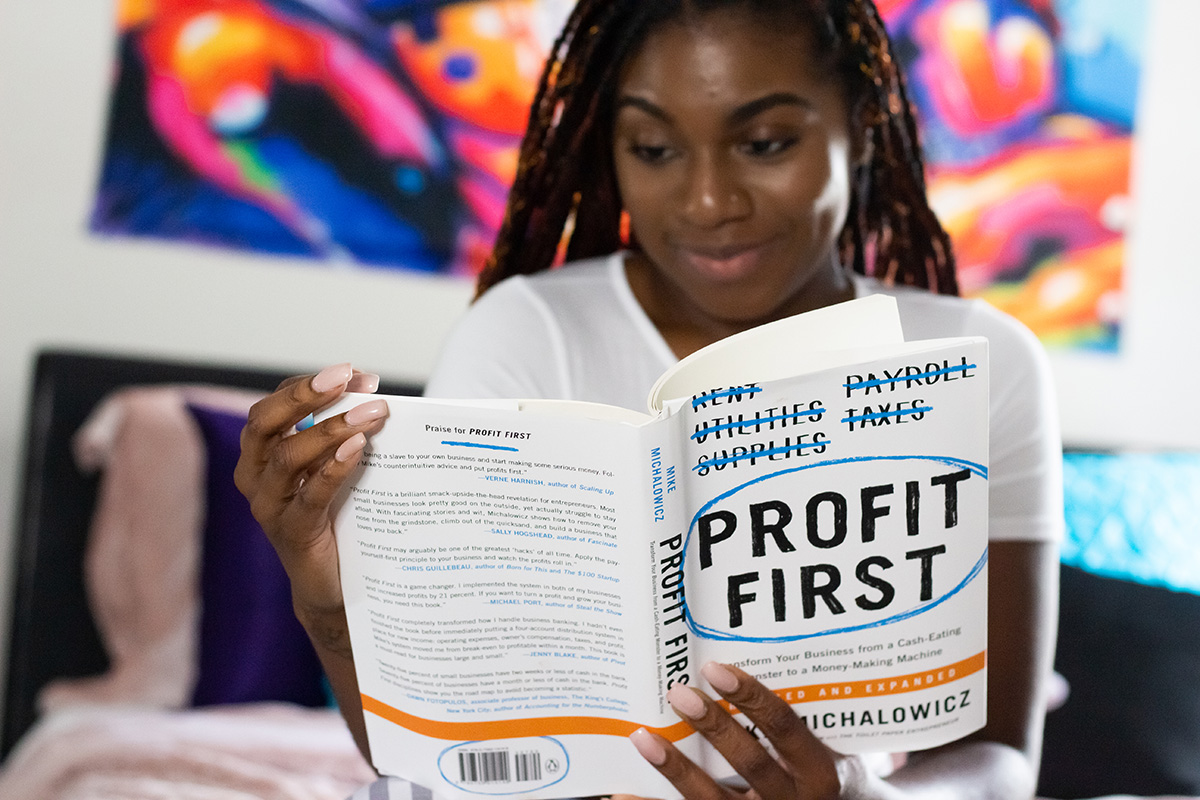

Through the power of technology, you can easily access financial literacy resources and programs that can help you manage your money and build your wealth.

Today, many highly authoritative financial resources provide guides aimed at immigrants coming to the US. AskMoney, which features multiple guides on budgeting, loans, investments, taxes, and more, has a lot of information regarding government and financial processes in the US. This includes a guide dedicated to educational scholarships for Latinas to help them overcome the financial educational barrier that many immigrants face. You can also sign up for online courses on Coursera or Udemy to widen your knowledge of financial management practices.

Organizational resources

Recognizing the big wealth divide among various races in the US, several organizations have launched programs to promote financial literacy among black and Hispanic immigrants. Since black adults are behind their white contemporaries when it comes to financial literacy, the Project Ready initiative aims to promote equality by providing financial education for young individuals. The program teaches young people from immigrant backgrounds to make strong financial decisions. Likewise, national nonprofit organization Financial Beginnings provides no-cost financial education to help you achieve homeownership, higher education, or even secure retirement.

These financial resources are just one of the key factors that can help you start a better life in the US. So, if you want to learn more about immigration, business, and travel, check out our articles at the Black Immigrant Daily News. Through our updated articles, you can learn about the latest information and strategies for immigrants.