By NAN Business Editor

News Americas, NEW YORK, NY, Fri. May 29, 2020: As many businesses and countries begin reopening following over two months of lock-down due to the COVID-19 pandemic, a wider net of the ‘victims’ of the virus is emerging. Among those new ‘victims’ is the commercial lending sector, especially as it relates to new retail and hotel development and construction.

Banks, according to Invest Caribbean CEO, Felicia Persaud, have redlined the sector globally, not just for the Caribbean. She said “new commercial real estate and project finance deals are going through a tougher and tightened initial screening process.”

ICN, she disclosed, now has millions in project finance deals on hold because of the redlining caused by the pandemic, which is making closing a deal in an already tough region, even harder.

Beginning in mid-March, Persaud said partner banks were already pulling back from the travel sector and now it has only gotten worse, as the sector also falls victim to the pandemic.

Banks are estimating deeper declines in passenger travel for COVID-19 versus MERS or SARS, which translates to less international spending, including in hotel stays and in demand for hotels, which translates to lower revenue in this sector, so lending to hotels is being shelved rapidly, she added.

Many analysts are also forecasting that the bounce back, which could come until 2021, will not fully offset the decline in 2020, and this estimate is being exacerbated the more travel declines, said Persaud.

SILVER LINING?

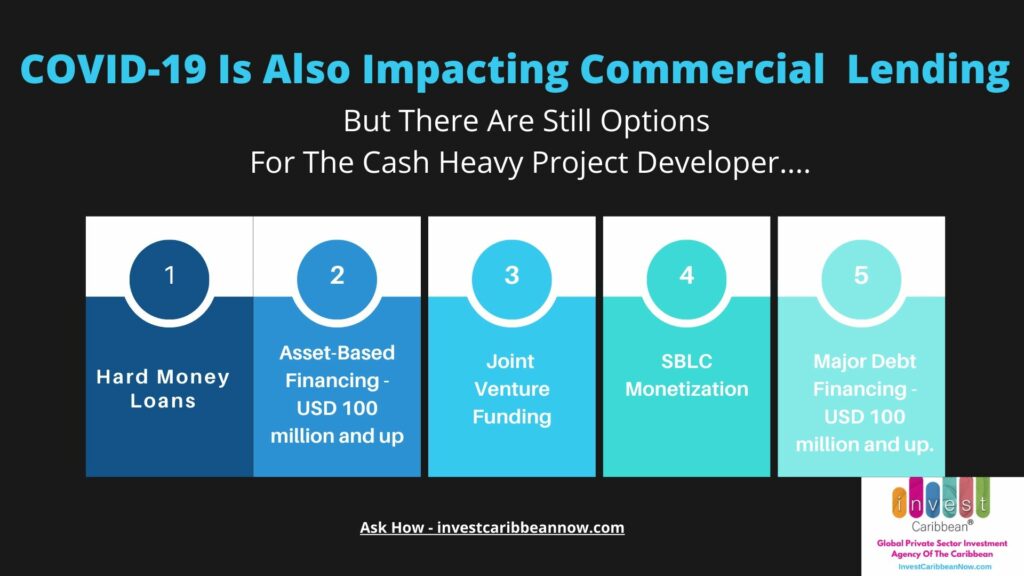

But the ICN founder said there are still options for people looking to borrow or refinance as long as they are cash heavy.

“The only lenders who are lending now into the real estate and travel sectors are private lenders offering essentially hard money loans, by pegging their bets on the asset’s value – whether land or building,” said Persaud. “So those deals can be closed in less than two months as long as the Loan To Value is high and the client is cash heavy.”

She also noted that the hot sectors now of interest to lenders are health care, manufacturing, biotech and real estate, but only as it relates to plants and warehouses.

“Banks are looking for deals in these sectors, but they must be USD 100 million and up right now. These are the deals that are going to the front of the line as hotel deals get sidelined. Sadly, that’s the state of commercial lending and development in the COID-19 era,” Persaud said.

For more information on current commercial real estate finance options from ICN, see here or contact Invest Caribbean today.