Compiled By NAN Business Editor

News Americas, NEW YORK, NY, Thurs. April 1, 2021: Here are all the top headlines you can use, making Caribbean business news this week:

REGIONAL

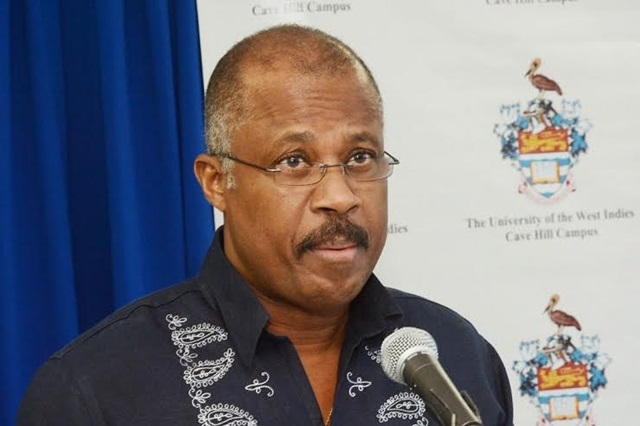

The University of the West Indies (The UWI) is set to float a US$60 million dollar bond on the Trinidad & Tobago Stock Exchange. The goal is to get out of financial trouble according to Vice-chancellor Professor Sir Hilary Beckles.

It is the first time UWI has gone to the capital market – in its 73-year history. The money raised will be used to build a state of the art offshore medical school in the twin-island state, a move which could lead to more than 25 per cent of The UWI’s revenue moving forward.

In addition, there is a plan for The UWI’s Open Campus to expand significantly by increasing its enrollment from 8 000 students to 80 000 over a short period, which could also bring in millions over the next three years. It’s all in the push to become less dependent on regional governments and a player as a commercial entity.

BARBADOS

The Caribbean Development Bank estimates project debt in Barbados will reach BBD11.25 billion at the end of March 2022, growing 8.5% y/y. A fiscal deficit of 8.1% of GDP is projected for this fiscal year, reports Caribbean economist Marla Dukharan in her Caribbean Economic Report March 2021.

THE BAHAMAS

Foreign exchange needs are expected to exceed inflows in 2021 again in the Bahamas. The country’s Central Govt external debt increased 57% y/y in Jan 2021 to USD4 billion and total direct debt increased 22% y/y to BSD9.4 billion, Dukharan said.

DOMINICAN REPUBLIC

Fitch is projecting a post-pandemic deficit of 4.2% of GDP through 2022 in the Dominican Republic. FDI is expected to strengthen in 2021, and will lower the current account deficit, which reached 1.8% of GDP in 2020. Inflation in January was 5.35% and is expected to return to the target range of 4.0 % ± 1.0 % by mid-year, states Dukharan.

JAMAICA

Fitch expected debt/GDP to rise to 111% by the end of March 2021, then reassume its downward path in Jamaica. Fitch is forecasting growth at 4.5% in 2021, and 5.2% in 2022. However, Jamaica continues to experience healthy growth in net remittances with the latest numbers for December 2020 showing inflows of US$282.4 million, representing an increase of 39.5 per cent or US$79.9 million relative to December 2019.

The Bank of Jamaica (BOJ) reports that this increase emanated from an increase in gross remittance inflows of 35.3 per cent or US$78.7 million aided by a decrease of 6.2 per cent or US$1.2 million in outflows.

BVI

The British Virgin Islands experienced the fourth-highest decline in gross domestic product of the Caribbean Development Bank’s 19 borrowing member countries in 2020, according to the CDB’s Regional Report: 2020 Review and 2021 Outlook, released late last month.

With its 18.9 percent drop in GDP, the BVI found itself behind only the tourism-dependent countries of Anguilla, Turks and Caicos Islands and St. Lucia, which experienced declines as high as nearly 30 percent.

TRINIDAD & TOBAGO

INVESTMENT holding company TTNGL has declared a fall in profits by 95 percent when compared with 2019. TTNGL holds 29.25 percent stake in Phoenix Park Gas Processors Ltd (PPGPL), the Point Lisas-based company that produces propane, butane and natural gasoline, mostly for export. PPGPL is majority-owned by the State-owned National Gas Company.

In a statement, TTNGL said its “lower financial performance relative to 2019 is reflective of the impact of the Covid-19 pandemic, which hit the global energy sector particularly hard.” The after-tax profit was $6.4 million for the financial year ending December 31, 2020.

SAINT VINCENT AND THE GRENADINES

Government revenue in Saint Vincent and the Grneadines for January 2021 fell by EC$13 million compared to the same period of 2020.

Prime Minister Ralph Gonsalves made the disclosure on Wednesday, noting that he and Finance, Camillo Gonsalves, had noted in the Budget Debate this month that 2021 would be a more difficult year, at least until October.

He said that revenue fell minimally year on year in 2020 because the country never went into lockdown and also because the Vincentian economy is not as tourism-dependent as, for example, Antigua, St. Lucia and Barbados.

SURINAME

Suriname extended a deadline on Wednesday for its bondholders to approve its latest debt deferral plan to April 8.

Suriname said the extension followed moves in “recent days” to give the bondholders additional macro-fiscal data, information on possible future oil and gas revenues and it had re-affirmed it didn’t intend to sign-up to an IMF programme without bondholders’ input.

GUYANA

The first cargo from new oil producer Guyana to the world’s third-largest crude importer, India, departed late last month from a production facility off the South American nation’s coast in a vessel chartered by trading firm Trafigura, data from Refinitiv Eikon showed on Tuesday.

The cargo was bought by HPCL-Mittal Energy Ltd, a joint venture between state-run Hindustan Petroleum Corp and steel tycoon L.N. Mittal, a source with knowledge of the matter said. HMEL operates a 226,000 barrel per day (bpd) Bathinda refinery in the northern state of Punjab.

India has asked refiners to speed up the diversification of imports to cut their dependence on Middle Eastern crudes after OPEC+ decided this month to extend production cuts through April, two sources told Reuters.