Commentary By Darshanand Khusial

News Americas, NEW YORK, NY, Mon. July 1, 2024: If you and a partner invest in a boat and decide to split profits equally, you will feel cheated if her share is much greater than 50%.

For instance, if from the day’s catch of 200 pounds of fish, you both decide that 100 pounds of fish should cover the expenses such as bait and fuel, then there will be a profit of 100 pounds of fish to share. Your profit take will be 50 pounds and hers will also be 50 pounds.

Exxon and its partners in the Stabroek Block have a 50/50 profit-sharing agreement with Guyana for extracting our oil. However, when looking at the 2023 accounting profit numbers for the oil companies compared to what was deposited in the Natural Resource Fund (NRF) for Guyana, one would question how this can be a 50/50 profit-sharing agreement?

In a Stabroek Article on Feb 10th, 2023 titled, Renegotiating PSA would be ‘very destructive’ to investor confidence – Routledge, the President of ExxonMobil Guyana, Alistair Routledge in response to this question, “There is a wide public view that Exxon and its partners are benefiting from the 11 billion barrels of oil more than Guyanese.” is said to have made this point, ” he [Routledge] was quick to point out that the view is unrealistic as the Guyanese people are benefiting more from the deal than the investors. He said it is very clear that under the Stabroek Block PSA, 50% of the profit goes to the country and 50% goes to investors. He noted that an additional 2% from the investors’ share goes towards the payment of royalty which results in Guyanese receiving a total of 52% of profit oil.“

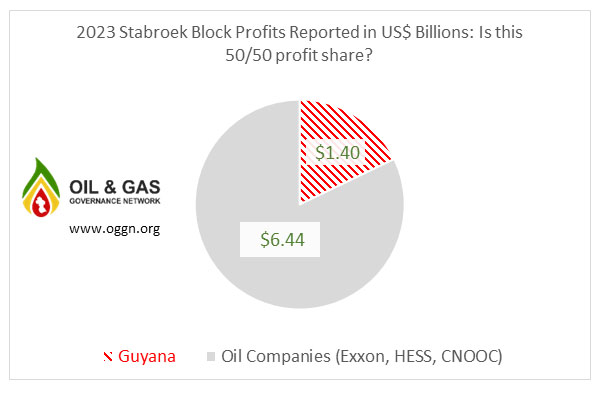

The industrious Chris Ram has published a trio of articles on the 2023 financials of the oil companies, adding to his masterpiece of 132 columns on Oil & Gas, see HERE. If one extracts the 2023 pre-tax profit for the oil companies from his articles, they add up to US$7.8 billion. Now, one would expect in a 50/50 profit share, Guyana in 2023 would receive US$3.9 billion (US$7.8 billion divided by 2) in profits. However, according to the 2023 Natural Resource Fund, Guyana’s 2023 share of profits was only US$1.4 billion. To put it another way, Guyana collected 17.9% of the total reported profits of US$7.8 billion reported in the 2023 oil companies’ financials (see chart below).

Exxon has a billboard claiming Guyana receives 52% of all profits from the Stabroek Block. The 17.9% of profits Guyana received in 2023 appears to invalidate this claim. The perception among Guyanese that Exxon and its partners benefit much more from our oil seems to be accurate based on the 2023 financials of the oil companies.

We can’t pay our teachers a living wage, and 40% or more of our population can’t afford enough protein to eat. The government should explain, how in a 50/50 profit share agreement, Guyana only received US$1.4 billion while the oil companies reported total profits of US$7.8 billion. The government has refused to renegotiate the lopsided Stabroek Block contract. Is it more worried about Exxon’s investor confidence than the plight of Guyanese?

EDITOR’S NOTE: Darshanand Khusial is a director of the non-profit Oil and Gas Governance Network, OGGN