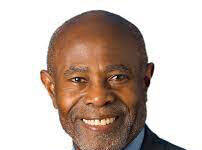

LOS ANGELES, Sept. 5, 2017 /PRNewswire-HISPANIC PR WIRE/ — Joel Peña has joined DoubleLine Capital LP as head of the firm’s institutional and intermediary investor relations in Latin America and the Caribbean. Mr. Peña comes to DoubleLine from international asset manager Robeco where he served as managing director for Latin America and U.S. Offshore.

In addition to heading DoubleLine’s institutional and private client relations in Latin America and the Caribbean, Mr. Peña will manage relations with overseas clients, advisors and distributors engaging the firm via its U.S. offshore platforms.

“Thanks to economic growth, a broadening middle class and rising standards of living, countries in Central and South America have seen growth in assets entrusted to pension funds, insurers and other fiduciaries. These institutional investors are looking beyond their local markets for investment opportunities and expertise,” said Ron Redell, executive vice president of DoubleLine. “My colleagues and I are delighted to welcome Joel into the DoubleLine team to sharpen our focus on the needs and objectives of institutional and private investors in Latin American and the Caribbean.”

Mr. Peña has 16 years of experience in asset management. Prior to Robeco, he served nearly six years as head of institutional clients in Latin America for fixed income manager PIMCO. Mr. Peña began his career in asset management at BBVA Bancomer in Houston and Miami before joining Bank Hapoalim as senior private banker. He holds an undergraduate degree in economics from Instituto Tecnológico y de Estudios Superiores de Monterrey, Tecnológico de Monterrey, Mexico, and an MBA from the Stern School of Business, New York University. He is a CFA and CAIA charter-holder.

“Navigating markets in today’s complex environment is far from easy. Very few firms have been as successful at it as DoubleLine,” Mr. Peña said. “I look forward to leading the expansion in Latin America within this organization, a company which is fully committed to always putting its clients’ needs first.”

About DoubleLine Capital LP

DoubleLine Capital LP, a registered investment adviser under the Investment Advisers Act of 1940, acts as the investment adviser for the Fund. As of the June 30, 2017 end of the second quarter, DoubleLine Capital and its related companies (“DoubleLine”) managed $109 billion in assets across all vehicles, including open-end mutual fund, collective investment trust, closed-end fund, exchange-traded fund, hedge fund, variable annuity, UCITS and separate account. DoubleLine’s offices can be reached by telephone at (213) 633-8200 or by e-mail at [email protected]