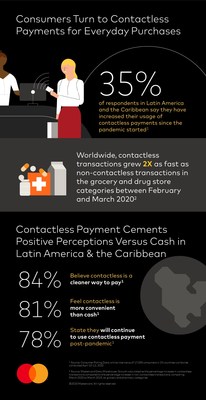

MIAMI, April 30, 2020 /PRNewswire-HISPANIC PR WIRE/ — During first quarter of 2020, as many countries imposed necessary restrictions on social distancing, a growing number of consumers in Latin America & Caribbean (LAC) turned to contactless payments for necessary purchases, a new Mastercard study shows. According to the survey, 35% of people in the region have increased their usage of contactless payments, citing simplicity, safety and cleanliness.

Consumer polling by Mastercard paints a picture of accelerated and sustained contactless adoption. This shift in consumer behavior is particularly clear at checkout as people express a desire for contactless cards and concerns over cleanliness and safety at the point of sale, according to the study. In fact, findings of the study show that the impact of social distancing and other safety guidelines on consumer payment behavior is extensive:

- 56% of Latin Americans said they are more aware of dirtiness of cash.

- 84% of Latin Americans believe contactless is a cleaner way to pay.

1. Mastercard’s own initiatives, along with the intelligence of its technology, data analytics and investments in security, will continue to propel a world beyond cash. Already, more than half of consumers around the world (63%) are using cash less often, or not at all, since the pandemic began. The same is true in LAC, where on average 66% of consumers are using cash less often, or not at all:

- 77% of Brazilians indicated that they are using cash less, or not at all, since the pandemic.

- 61% of Colombians indicated that they are using cash less, or not at all, since the pandemic.

- 68% of Costa Ricans indicated that they are using cash less, or not at all, since the pandemic.

- 58% Dominican Republicans indicated that they are using cash less, or not at all, since the pandemic.

2. Consumers are quickly appreciating the benefits of contactless payments with 79% across LAC finding them more secure when compared to keeping or paying with cash. Additionally, regional consumer polling by Mastercard indicated sustained contactless usage with consumers preferring the quick and efficient checkout experience.

- 78% of Latin Americans indicated they will continue using contactless payments even after the pandemic is over.

- The belief was even stronger among those under the age of 35, where 82% of this population indicated continued use post-COVID.

“As we all experience the first global pandemic in an age defined by the digitalization of our lives, contactless card payments have taken on a new urgency. It has been both encouraging and gratifying to see our partners throughout the LAC region adopt the changes and acceleration of contactless. The technology is available, and it’s clear that the change we are witnessing in consumer behavior is here to stay,” said Walter Pimenta, Senior Vice President, Products & Innovation, Mastercard Latin America and Caribbean.

Accelerating faster, cleaner, safer payments

Throughout the world, Mastercard has been spearheading the transition to contactless for more than 15 years, championing it as the simple, safe and fast way to pay. As a region with countries where contactless technologies are a newer experience, LAC has seen a rapid increase in infrastructure, with 75% of point of sale terminals ready to accept contactless transactions, and 60% of financial institutions issuing contactless-enabled cards.

In March, Mastercard led a move to increase the contactless payment limits across the LAC region as people looked for safer ways to pay in the wake of the COVID-19 pandemic. Today, four countries have already raised their contactless payment limits including, Colombia, Argentina, Dominican Republic and Costa Rica, with many others expected to follow soon. The initiative is in line with similar actions taking place around the world as health officials recommend social distancing and a growing number of merchants are encouraging consumers to pay with contactless instead of cash to avoid contact.

“As the spread of COVID-19 highlights the steadfast mindset for ‘contact-free’ environments and experiences in many aspects of our lives, the increased interest in contactless payments is far reaching. We believe in providing consumers with the freedom of choice in how they pay and peace of mind when they pay. With increased convenience and security, we look forward to expanding the contactless footprint more than ever before,” added Pimenta.

Contactless Payments Growth

As consumers increasingly seek out ways to quickly get in and out of stores without touching terminals, Mastercard data reveals over 40% growth in contactless transactions globally in the first quarter of 20201. Further, 80% of contactless transactions are under $25, a range that is typically dominated by cash. LAC, a less mature region when it comes to contactless penetration, saw exponential growth, with contactless transactions up 500% overall since March of last year.

While countries worldwide are at different stages of contactless card deployment and usage for daily shopping habits, Mastercard’s insights on grocery and pharmacy trends – two areas where many day-to-day essentials are being purchased – showed that nearly all regions experienced significant spikes in February and March. Further, reinforcing changing behaviors and consumer checkout preferences, Mastercard saw the number of contactless card payments at grocery stores and pharmacies grow twice as fast as non-contactless transactions globally2.

Notes to Editors:

1 Growth calculated as the percentage increase in contactless transactions compared to the percentage increase in non-contactless transactions, comparing March 2020 to March 2019, at Grocery and Pharmacy categories

2Growth calculated as the percentage increase in contactless transactions compared to the percentage increase in non-contactless transactions, comparing March 2020 to February 2020, at Grocery and Pharmacy categories

Survey Methodology

- Online interviews of 17,000 consumers in 19 countries worldwide

- 1,000 banked respondents per country in the US and Canada (North America); Australia, Singapore (Asia Pacific); UAE, Kingdom of Saudi Arabia, South Africa (Middle East and Africa); UK, Italy, France, German, Spain, Poland, Russia, the Netherlands (Europe).

- 500 banked respondents per country in Brazil, Costa Rica, Dominican Republic, and Colombia (Latin America and the Caribbean)

- Research conducted April 10-12, 2020

- Nationally representative sample

- Readable sample sizes of:

- Gen Z/Millennials

- Affluent [defined at a country level]

- Contactless users

- Primary shoppers

- Those with high levels of concern about Covid-19

About Mastercard

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.