News Americas, DALLAS, Texas, Fri. April 1, 2011: Several former investors in R. Allen Stanford’s bank are now suing the U.S. Securities and Exchange Commission.

The investors, in a lawsuit, blames the SEC and Spencer Barasch, a partner at the Dallas law firm Andrew Kurth, who worked for the SEC for twenty years, for failing to stop the alleged Ponzi scheme.

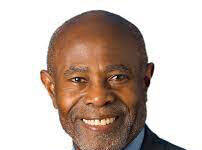

The once flamboyant Stanford is accused of perpetrating a $7 billion Ponzi scheme that left many of his investors broke.

Investors claim Stanford was on the feds radar as far back at 1997 but they refused act and Barasch looked the other way while the Texas-born, former Antigua resident, swindled billions.

The complaint reads in part that investors lost their investment in Stanford International Bank, Ltd (“SIBL”) because “of the negligence and misconduct of employees of the United States Securities and Exchange Commission (SEC).”

Stanford is currently inmate #35017-183 and is being held in Butner, N.C. after a judge ruled in January that he was incompetent to stand trial and recommended he undergo treatment for his reported traumatic brain injury, addiction to an anti-anxiety medication and major depressive disorder at a federal facility with suitable medical capabilities. He has pleaded not-guilty to all charges.